Doxa / commonly held belief creates bubbles.

Falsification creates παρά (para) – anti = paradox investing!

In my experience, doxa — “commonly held belief, popular opinion,” as Aristotle described it — can be propagated without verification or rational process and cannot become episteme, yet it can create bubbles. (There are four types of propagation of a doxa according to Aristotle.)

At the margin, they become religious dogma — ortho-doxa — the “right belief” or the “glorious belief,” Hebrew כָּבוֹד (kavod).

“Right” is the issue, because people defend their beliefs more dearly than their property, and this can lead to conflict. If there are three religious beliefs, and schisms within them, how can they all be “right”?

But I digress. The process of falsification of a doxa is, to me, the most interesting investment process: a generally held belief that can be falsified. Then it becomes a παρά (para)–doxa… paradox.

Paradox investing is what I am very fond of.

Today, Longi trades at an EV-to-sales multiple that is quite low, with cash flow just turning positive in the last six months.

Why “para”-“doxa”?

Doxa: You will hear a lot on Twitter that renewables are not the future. And believe it or not, many fossil fuel advocates tell us that China ignores renewables. Yes, I have seen dozens of those posts recently.

Quite a few accounts spread the “Ortho-doxa” on renewables and on China.

It would be naive to ignore that platforms exist to organize and push narratives on social media, including paying influencers for that.

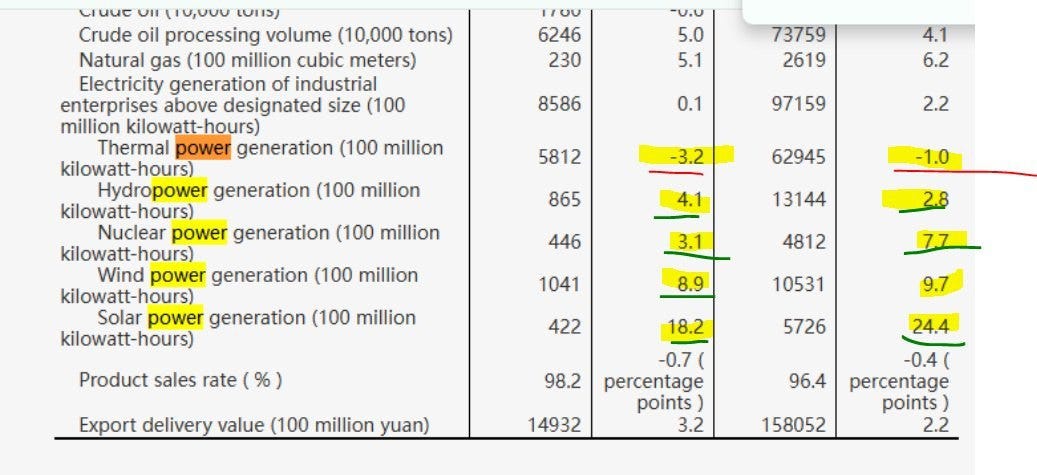

Falsification — data in China below on power generation:

Thermal: down -1% YoY (full year), -3% YoY (monthly)

Wind: up +9.7% YoY (full year)

Solar: up +24% YoY

https://www.stats.gov.cn/xxgk/sjfb/zxfb2020/202601/t20260119_1962329.html

Several falsifications of doxas:

Doxa 1 falsified:

“China relies on thermal power to grow its power generation.”

FALSIFIED - ERASED: Thermal power production is decreasing in 2025.

Doxa 2 falsified:

“China’s electricity growth has to come from nuclear.”

FALSIFIED - ERASED: Nuclear electricity production is only one-third of renewables and grows more slowly than both solar (+24.4%) and wind (+9.7%).

Doxa 3 falsified:

“China does not believe in renewables.”

FALSIFIED - ERASED: Renewables shoulder the bulk of power generation growth in China today.

A beautifully falsified belief — doxa — or, stated otherwise, a beautiful investment paradox.

And I am not even going into the details of the reduction of older solar manufacturing capacity, nor the natural boom in demand that a 50% more efficient process would create.

A supply curve that brings prices down naturally stimulates demand. There is no falling marginal utility in energy in the same way there is with goods like spring water — people do not drink 20 liters per day; there is a cap. But there is no such cap in energy.

People always find a use for more, cheaper energy.

The system of doxa detection from GraphFinancials — and potential falsification bringing a paradox investing situation — is coming soon. Register early for free now!

https://graphfinancials.com/doxa